How to access payable

Change direct debit details on Payble?

CSO:

- Neither the Rates team or Customer Service can update their bank or card details, due to the privacy act

- Customer Service staff can send them a link to their registered phone via Payble. (call the support team if you are having trouble)

- Click on Payable Admin and follow instructions to send an SMS to change bank or card details

- Instructions

Dont have the QR code?

CSO:

1. The QR code is unique to each property, it's printed on their original statement. If they do not have a copy, you can send them one from Lane Print - Copy of the Rates Notice

2. The other option is to go to pay.greaterdandenong.vic.gov.au

When will my account be debited if payment due on Public Holiday/Weekend?

- If it is a card payment it will process on the day (approx. 2 pm)

- If it is a bank account, it will be deducted the following working day

I didn’t have enough money in my account and my instalment was declined, what can I do now?

- The system will try to deduct the payment again within 2 days for credit cards and up to 4 days for bank accounts (depending on the customers' bank).

- If the customer does not have the funds available, they can skip this payment by logging into the payble website and the payment amount will be spread across the remainder of the payments. There is a limit of 4 skips per financial year and customers cannot skip the last payment.

How many times do we attempt to debit before the arrangement is cancelled?

Three times and then they will have to set it up again on pay.greaterdandenong.vic.gov.au

How many instalments can I make on Payble?

Payment options on Payble is:

Weekly

Fortnightly

Monthly

4 instalments 30th Sept, 31 Nov, 28th Feb and 31 Mar

The system will provide the number of payments depending on when they set it up and how much is owed to complete payment by 31st May 2024.

All rates will need to be paid by the 31st of May of each financial year via this method and it will include arrears.

If they need more time to pay, they should enter into a Rates arrangement directly with Council.

Go to this page for this information

If a customer sets up instalments via Payble and they decide to pay via a different method. What happens then?

It depends on if they pay the full balance at Council or a part payment. If they pay the account off in full then,they will need to cancel Payble.

If they are paying an installment amount then no they don’t need to. All payment data is updated on Payble daily and their account will adjust accordingly with 12-hour - 24-hour timeframes.

My account has been debited for more than what I set up to pay, what can I do

Check the amount setup on the payment plan with Payble as they may have skipped a previous payment or missed a payment and the direct debit has adjusted itself. Customers will always get a text message advising them of the amount that will be debited and when so there should be no surprises, but if they do they email Council@cgd.vic.gov.au with evidence of additional payments.

How can I change payment frequency, cancel payment plan or skip next payment?

Log onto the website pay.greaterdandenong.vic.gov.au and access your account. Then click the options link and make your change.

Troubleshooting - Payble gives me an error when I try to make changes?

All trouble shooting isues

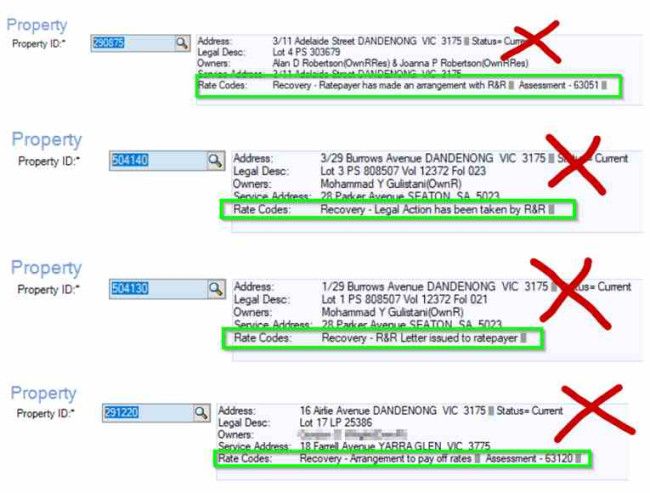

Can I set up Payble if Rates have been sent to R & R?

If the property is showing these recovery codes, you cannot set up a Payble arrangement

- R&R Arrange

- R&R Legal

- R&R Letter

- Arrangement

Do residents using Payble need to set up a new plan in Payble for the new financial year?

No, residents already set up in Payble, do not need to do anything. They will receive an SMS with their new payment amounts once the 2024/25 rates are determined and communicated to Payble.

Residents on 9 or 4 instalment payments previously with Council as direct debit?

Residents on 4 installment payments previously transitioned to Payable in 2022/2023. If they want to leave it as 4 payments, then they do not need to do anything, the new rates will just continue to be deducted.

Residents 9 installment payments

9-installment plan, resident were transitioned to Payble in 2022/2023. From July 1, 2024, the 9-installment option will no longer be available. These residents will be automatically switched to monthly payments.

If a resident does not want to switch to the monthly payment plan, they will need to contact the Council to cancel their current Payble account. Only the Council can process this cancellation. Afterward, they would need to register to Payble themselves.

Does Payble show up in Property & Rating?

Once a customer has been set up Payble, it make a day or two for it to be reflected on P&R.

If my Rates are in arrears but have not been referred to R & R, can I set up Payble?

Yes, you can set up payments for Rates via Payble even if you have arrears.

When you choose a weekly, fortnightly, or other payment option, Payble will calculate the total amount owing, including arrears.

If you proceed with the arrangement, interest on the arrears will not be charged.

Rates Notices

You’ll receive your first Rates Notice by post or email, depending on your setup. No further notices will be sent, as they are just reminders. If you're paying via Payble direct debit, reminders aren't needed.

Annual Rollover SMS notification by Payble

Payble sends SMS annually advising that Payble is rolling over.

Example 1

If they signed up to Payble last FY and did complete the plan, they will receive the below SMS:

"Notices for {address} will be issued soon.

Your previous payment plan will be automatically rolled over for this new notice.

This means your first {frequency} payment of {amount} will be deducted on {date}.

You can review, edit or cancel your payment plan via your Payble account. "

Complete plan – means all payments were made by direct debit as they set it up.

If they had signed up to a Payble account last FY but didn’t not complete it, they will receive the below message:

"Hi {name},

Your notice will be issued soon for {address}.

You can sign up to a new plan via Payble. "

Incomplete plan – means a payment or payments were made outside the direct debit plan, e.g. paid to customer service or Bpay. This is for both situations, where the account is zero before the start of the new financial year or not.